Sydney

9/255 George Street,

Sydney NSW 2000

02 9221 4066

JANAadmin@jana.com.au

In recent months, we’ve seen more than one news headline claiming that soaring energy prices mark the end of sustainability being a top priority for investment strategies.

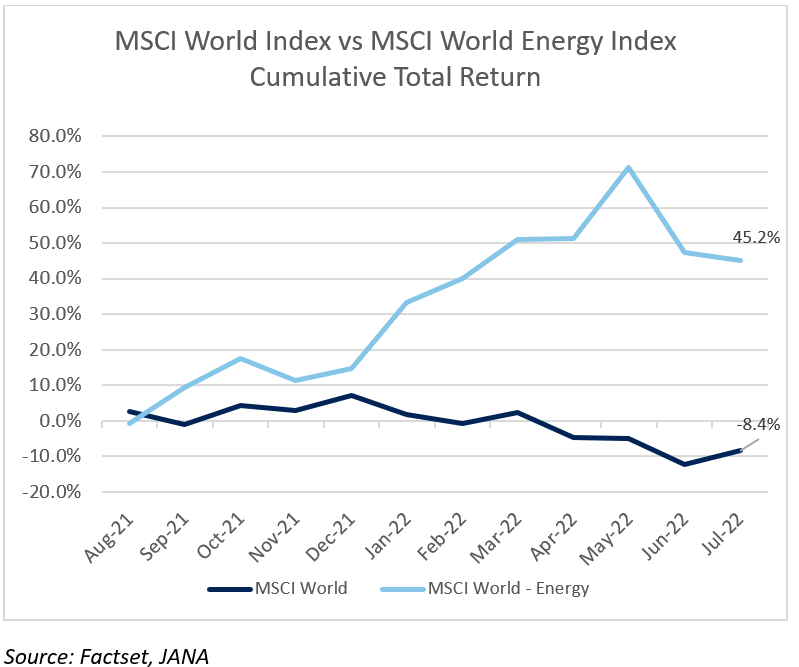

Energy prices have been booming, and with this the energy sector has surged, strongly outperforming the broader equity market. This has posed challenges for investors that have allocated away from the energy sector as part of their net zero and broader sustainability plans and raised questions about the trade-off between targeting sustainability goals and delivering on investment objectives.

While the energy sector is not a substantial part of global equity markets, representing just 4.7% of the MSCI World Index today, up from 2.8% a year ago, the quantum of outperformance has been enough to see portfolios with low energy weights meaningfully underperform. Where this underweight has extended into other parts of the portfolio, such as credit markets, this has been more substantive.

Concerns about the potential performance impact of pursuing ESG and other sustainability goals is not new. While there are some that will be quick to jump to the conclusion that underperformance of ex-energy portfolios over the last year is evidence that sustainability considerations come at a cost to returns, it’s important to take a longer-term perspective when considering the impact of the position.

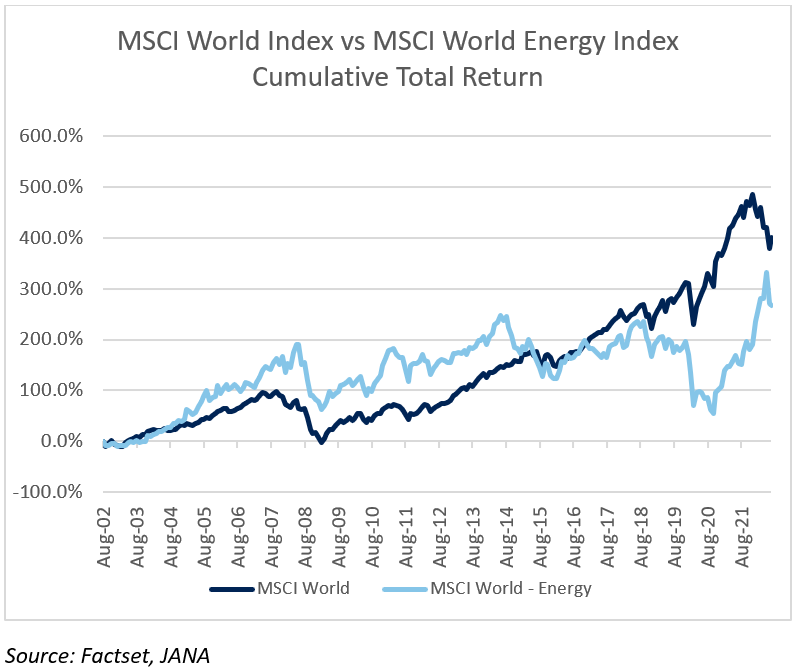

As with all backward-looking analysis, altering the start date of the analysis period can lead to a very different picture. The energy sector has both out and underperformed the broader market at different times and has done so with significantly more volatility than most sectors.

So while an underweight energy position has hurt over the past year, if we consider returns since 2011, the year that the Carbon Tracker Initiative first released its “Unburnable Carbon” report, arguing that the financial markets were not adequately considering the future impact of an energy transition and the potential for stranded assets in energy companies, the Energy sector has delivered a return of just 4% per annum against a return for the MSCI World Index of 18% per annum.

Managing portfolio risk

Taking any position that is different from the standard market benchmark will introduce tracking error risk and can result in significant out- and under- performance for extended periods of time. This isn’t necessarily a problem, so long as the investor’s portfolio is structured to meet its objectives.

However, it may be more challenging for investors with external pressures, such as peer relative performance pressure or, for superannuation funds, the Your Future, Your Super performance test. These investors must balance a broader range of objectives and constraints. Having a clear understanding of the degree to which deviations from market benchmarks can be tolerated and sizing appropriately is required, as is the case for all investment risk taken by investors.

When considering how to mitigate tracking error risk while meeting portfolio carbon reduction targets, there are multiple approaches investors may consider:

Path to net zero is complex and investors require a multi-faceted approach that considers both real world impact and manages stakeholder expectations.

In Conclusion

In recent months, we’ve seen more than one news headline claiming that soaring energy prices mark the end of sustainability being a top priority for investment strategies. While anyone observing the European energy crisis might consider this to be the case on a short-term view, the Ukraine war and resulting hike in energy costs has in many ways accelerated the urgency for clean energy transition, with high energy prices making what may have been marginal green energy projects more viable and geopolitical drivers providing a tail wind, particularly in Europe.

While we would never seek to predict just how long energy companies will outperform, we can be sure that energy will continue to be a volatile, cyclical sector and that the energy transition won’t be stopped.

Sydney

9/255 George Street,

Sydney NSW 2000

02 9221 4066

JANAadmin@jana.com.au

Melbourne

18/140 William Street,

Melbourne VIC 3000

03 9602 5400

JANAadmin@jana.com.au

Functional cookies

Functional cookies

Advertising

Advertising

Social media

Social media