Sydney

9/255 George Street,

Sydney NSW 2000

02 9221 4066

JANAadmin@jana.com.au

Whilst we’ve pointed out several gender-related gaps in the asset management industry we recognise that the industry is working hard to improve and evolve its corporate culture to attract and retain the best talent, which JANA is actively encouraging.

Among many topics covered in sustainable investing, diversity, equity and inclusion (DEI) has been garnering increasing interest as one of many environmental, social and governance (ESG) factors affecting financial performance. As asset managers analyse DEI within their investments, we examine the managers’ own approaches and corporate culture.

In recognition of International Women’s Day this article will focus specifically on gender-related DEI approaches within the asset management industry drawn from JANA’s survey covering over 150 investment managers globally. We’ll discuss observations we’ve made on board representation, equity and policies.

Our conclusions are based on the responses we received, this may reflect selection bias because leaders in this area who already collect the data were more likely to respond to the survey. As a result some conclusions we draw from the survey may appear better than reality.

Unfortunately, we are unable to share meaningful insights in relation to the LGBTQIA+ community within the industry at present due to the low response rate. This in and of itself suggests the community is relatively small within the industry or those that identify as LGBTQIA+ may not have come forward. Continued efforts to create safe and inclusive cultures within the asset management industry thus remains a priority.

Behind closed doors, fewer women make it through the glass ceiling.

While we recognise gender diversity across all levels of an organisation is important, the tone from the top filters down to the rest of the organisation. Role modelling of women in senior positions allows young women to see themselves in similar roles. Therefore, we’ll be focusing on gender diversity at the board level.

It is widely understood that companies need at least 30% representation from minority groups for them to impact board decisions. Research has also shown that companies with more female board directors produce stronger financial performance compared to peers1 and stronger sustainability considerations at board level2. As Ruth Bader Ginsburg said: “Women belong in all places where decisions are being made…It shouldn’t be that women are the exception”. Yet of the asset managers we surveyed we found that only 36% of their boards had 30% or greater female representation.

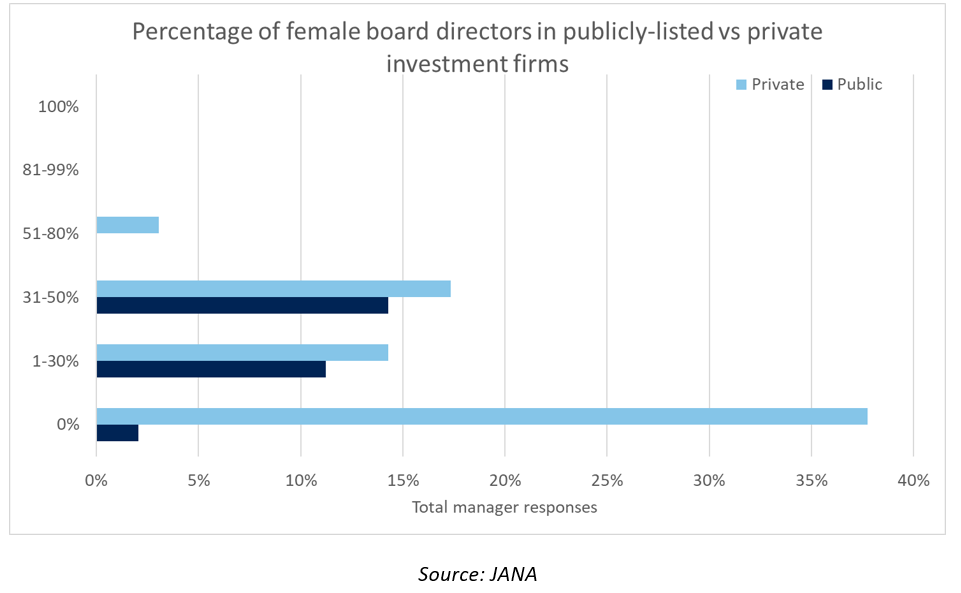

Drilling down further, the level of female board representation differed depending on the manager’s size and if it was publicly-listed or privately owned. The chart below shows the total manager responses divided by private ownership and public listing. A high number of privately owned firms had no female board directors at all (38% of total respondents). In this category, many tended to be small firms with less than 50 employees. The chart also demonstrates that most of the publicly-listed managers were likely to have at least one female board director, they represented 26% of managers who responded. The results reinforce the need for encouraging public disclosure of diversity data since greater scrutiny provides an incentive to improve the gender ratio of the board but also of the wider organisation.

Looking locally: managers tended to be in two camps; females are really well represented or not at all.

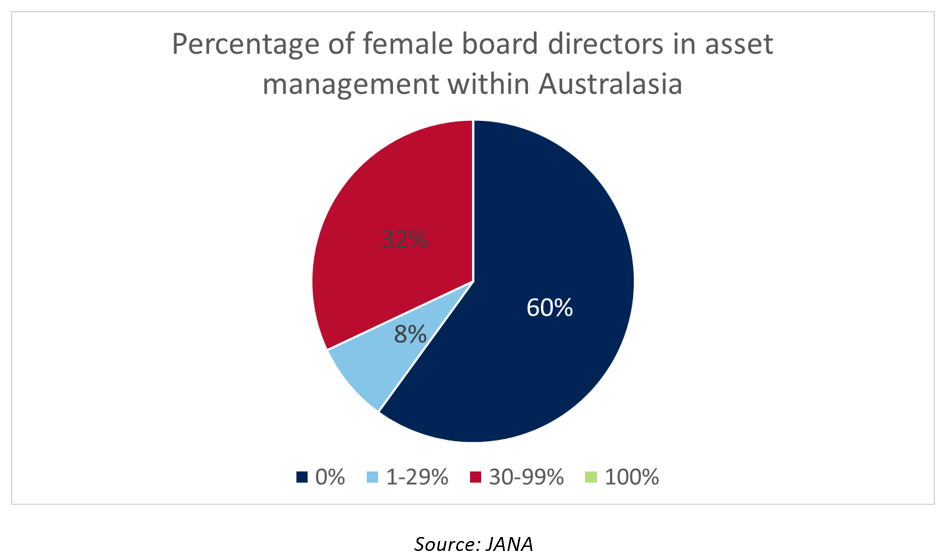

In Australasia, several initiatives exist to encourage the ASX200 and NZ50 boards to have at least 30% female board representation. Of the managers we surveyed that were headquartered in Australasia, 32% had greater than 30% female representation which is significant progress towards parity. This is in line with female directors on ASX200 company boards (34%)3 and in Australia’s finance and insurance sector (30%)4. However, more than half of the managers reported having no female directors on their boards.

It’s still a man’s world if women don’t have skin in the game.

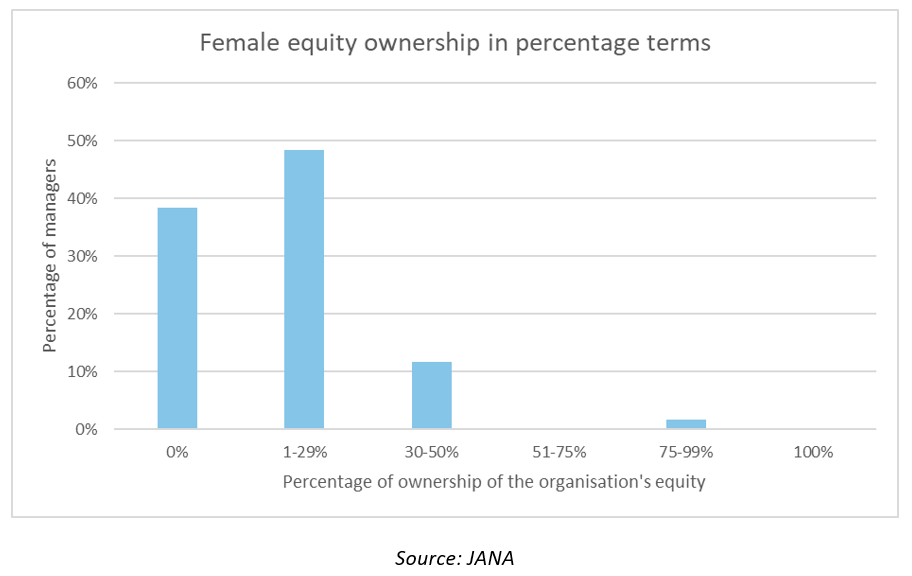

Our survey also shows that women owned a smaller portion of the investment firms compared to men. In the chart below, around 87% of managers reported women had less than 30% equity ownership in the investment firm. However, we believe this number could be even higher in reality since less than 50% of the managers responded. This is quite important because the proportion of equity ownership is a key determinant in one’s ability to influence business decisions. This can potentially hinder any meaningful transformations to corporate culture.

Diversity alone is insufficient to drive cultural change.

Asset managers must also ensure they foster equity and inclusion for DEI initiatives to succeed. Equity should not be confused with equality. Equity is ensuring everyone has a fair chance of accessing resources and opportunities. Equality is the outcome of being equitable.

Internal policies can provide a glimpse into the managers’ corporate culture. The following is our examination of DEI practices derived from the managers’ responses to our questions on policies & procedures covering recruitment, promotions & appointments and remuneration.

Merit based hiring and promotions: a focus on star performers rather than on star teams misses a beat

We noticed several responses mention that opportunities are given based on merit. Opportunities based on merit of an individual that fail to account for team dynamics and diversity are not optimising for outcomes. Successful strategies are built upon star teams comprised of a diverse array of individuals with complementary strengths. This is because investment strategies based on teamwork rather than the star manager are more resilient to key person risk and tend to have elevated and sustainable performance.

Eliminating bias from recruitment and promotions.

Eliminating unconscious bias is a priority as highlighted by this year’s International Women’s Day theme #Breakthebias. Best practice we see in the industry aim to do this through regular training for interviews and decision-making processes, especially right before decisions need to be made. Other best practices include using gender-neutral language in hiring, targeted recruiting and partnerships, and creating internal networks in larger investment firms to support the development and advancement of underrepresented minorities.

Achieving pay parity requires first identifying the gender pay gap.

On remuneration, some of the best practices we see include engaging third parties to conduct pay equity analyses and/or review remuneration policies to ensure pay parity. Many managers review remuneration policies regularly, appointing committees to provide oversight. However, few managers undertake gender pay gap analyses voluntarily outside of the UK where it is mandatory to do so for firms with more than 250 employees. In future survey iterations we would like to examine more closely the gender pay gap and how it affects the asset managers’ performance.

Speak up or speak out?

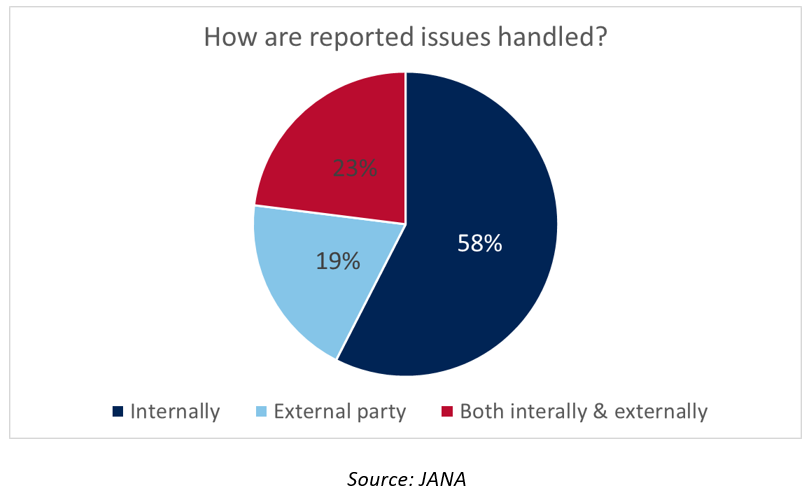

The Principles of Responsible Investment (PRI) newest DEI paper suggests investors consider including questions around whistleblowing, harassment and discrimination policies5. When these polices are well executed they create a safer and better environment for all. Almost all managers we surveyed have a Code of Conduct policy which also covers bullying, harassment and discrimination. Similarly almost all managers have a formal whistle blower policy as mandated by law in their respective countries. However, the chart below shows that more than half of the managers handled reported issues from whistle blowers internally. Many expect their employees to be comfortable speaking up. This overlooks the likelihood that some employees may be wary of the negative consequences of speaking to someone within the firm. This runs the risk of deterring whistle blowers from calling out misconduct which can have detrimental effects on financial performance. A small minority of leading firms that responded to our survey stated that they engage an independent third party provider to handle all claims. We would welcome this practice to be more widely disseminated throughout the asset management industry.

Final thoughts – this is just the beginning.

We still have much to uncover on gender parity in the asset management industry. We hope to collect more data in future surveys and cover topics such as the intersectionality of gender and ethnicity; how benefits & flexible arrangements are utilised across diversity groups and track the progress towards 30% representation. Whilst we’ve pointed out several gender-related gaps in the asset management industry we recognise that the industry is working hard to improve and evolve its corporate culture to attract and retain the best talent, which JANA is actively encouraging. The financial services industry is one of the top industries with the highest percentage of women on boards globally. We should be mindful that we are making progress in driving gender parity and celebrate our successes.

Sydney

9/255 George Street,

Sydney NSW 2000

02 9221 4066

JANAadmin@jana.com.au

Melbourne

18/140 William Street,

Melbourne VIC 3000

03 9602 5400

JANAadmin@jana.com.au

Functional cookies

Functional cookies

Advertising

Advertising

Social media

Social media